Top 3: How much money to save before moving out of state

Planning Your Financial Journey Across State Lines

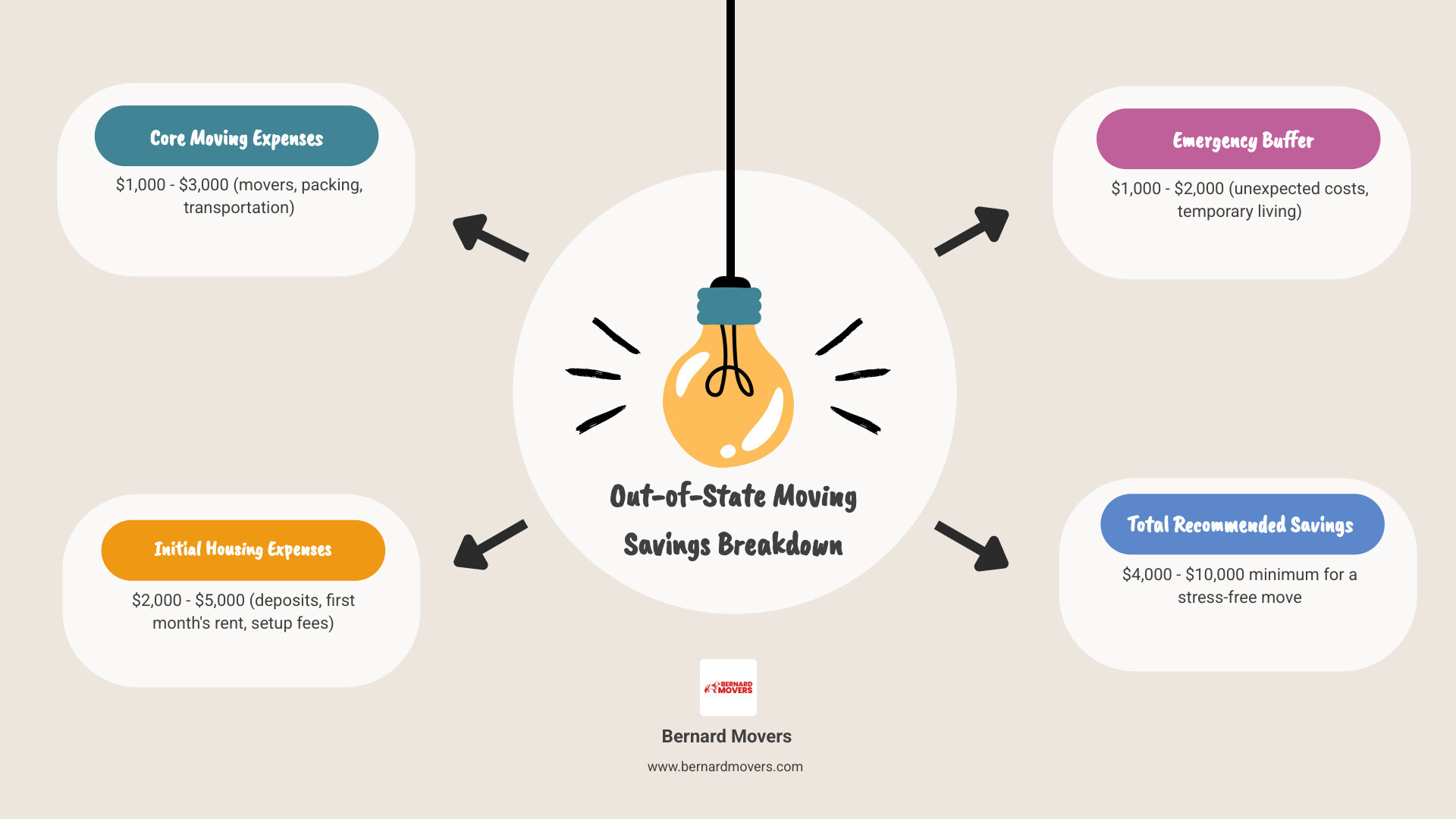

How much money to save before moving out of state is a critical question. The simple answer: most people need between $4,000 to $10,000 saved, depending on their destination and situation.

Quick Answer for Out-of-State Moving Savings:

- Moving costs: $1,000-$3,000 (professional movers, packing supplies, transportation)

- Initial housing expenses: $2,000-$5,000 (deposits, first month’s rent, setup fees)

- Emergency buffer: $1,000-$2,000 (unexpected costs, temporary living expenses)

- Total recommended savings: $4,000-$10,000 minimum

Moving across state lines involves more than just hiring movers. You’ll face security deposits, utility setup fees, travel expenses, and many smaller costs that add up quickly. From our experience helping families relocate from Chicago and throughout Illinois, proper savings lead to smooth, stress-free moves. Without it, an exciting life change can become a financial nightmare.

I’m Mina Georgalas, owner and president of Bernard Movers. With over 50 years of company experience, I’ve helped thousands of Illinois families understand exactly how much money to save before moving out of state for successful relocations to Florida, Georgia, and 43 other states.

Basic how much money to save before moving out of state terms:

- cost to relocate to another state

- least expensive way to move out of state

- things to do before moving out of state

Breaking Down the Budget: How Much Money to Save Before Moving Out of State

An out-of-state move is a major financial commitment. To understand how much money to save before moving out of state, you need to break down every expense category to avoid surprises and arrive at your new home with confidence, not credit card debt.

Core Moving Expenses: Transportation and Packing

This category covers getting your belongings from point A to point B, from professional movers to the gas for your own car.

Professional Moving Services

When relocating from Illinois to another state, professional movers save your back and your sanity. Long-distance moving costs depend on the weight of your belongings and the distance traveled, typically ranging from $1,500 to $6,000 or more. A 2-bedroom move from Illinois to Georgia, for example, averages around $3,000 to $4,000. Experienced movers handle logistics, insurance, and heavy lifting. In my 30 years of experience, families rarely regret investing in professional services.

Packing Supplies: The Hidden Expense

Whether you pack yourself or hire movers, you’ll need supplies: boxes, tape, bubble wrap, packing paper, and markers. For a typical home, materials run $100 to $500. Pro tip: buy more tape than you think you need.

Your Personal Journey Costs

You’ll need to budget for getting yourself to your new state. This includes fuel, hotel stays, and meals. Use AAA’s gas cost calculator for realistic estimates; a drive from Illinois to Florida might cost $200 to $400 in gas alone. Hotel stays average under $150 per night, and you should budget $50 to $75 per person per day for meals on the road.

Comparing Your Moving Options

Here’s how different approaches stack up when moving from Illinois:

| Option | Estimated Costs | Pros | Cons |

|---|---|---|---|

| Full-Service with Bernard Movers | $3,000-$6,000+ | Minimal effort, professional packing, insurance coverage, stress-free experience | Higher upfront cost |

| Self-Packed (Bernard Movers Transport) | $1,500-$4,000+ | More affordable, you control packing, professional transport | Requires significant packing time and effort |

| DIY Rental Truck | $1,000-$3,000+ | Lowest cost option, complete control | Very labor-intensive, injury risk, requires driving large vehicle |

Our self-packed option is a popular choice: you pack at your own pace, and we handle the heavy lifting and long-distance driving.

Securing Your New Home: Deposits and Initial Rent

Your next financial hurdle is securing your new home, which often comes with sticker shock. Most landlords require a security deposit (usually one month’s rent), first month’s rent, and sometimes last month’s rent upfront. For a $1,500 apartment, that could be $4,500 just to get the keys. Expect non-refundable application fees ($50-$100 each) and a pet deposit ($200-$500) if applicable.

Landlords also require proof of income (usually 3x the monthly rent), so having a job or substantial savings is crucial. Don’t skip renter’s insurance; at about $150 per year, it provides enormous peace of mind. Finally, research your destination’s rental market. Moving from Chicago to a smaller city in Georgia might save you money on rent, but it’s important to verify.

Settling In: Hidden Costs and Initial Living Expenses

The “settling in” costs often catch people by surprise. While small individually, they can add up to thousands.

- Utility Setup: Budget around $100 per utility for deposits (electricity, gas, water, internet), plus connection fees. Your first month’s bills will be higher.

- DMV Fees: Updating your driver’s license and vehicle registration typically costs $25 to $100 total.

- Home Essentials: New furniture can cost $1,000 to $3,000. Kitchenware, cleaning supplies, and linens add another few hundred dollars. Your first grocery trip will also be expensive as you stock an empty pantry.

- Miscellaneous Costs: Set aside an extra $300 to $500 for things like mail forwarding, takeout meals, new locks, and temporary storage. You’ll likely use every penny.

The Ultimate Safety Net: Your Emergency Fund

My top advice for anyone asking how much money to save before moving out of state is to build a substantial emergency fund. It’s critical when you’re in an unfamiliar place without your usual support network for car trouble, medical issues, or job insecurity.

Financial experts recommend three to six months of living expenses in an accessible fund. For an out-of-state move, aim for the higher end of that range. If your estimated monthly expenses are $3,000, an $18,000 emergency fund provides genuine security. This fund is separate from your moving budget—it’s your safety net for life after the move. For more on this, see our guide to creating a Moving Out of State Budget.

How to Create a Personalized Moving Budget

Now, let’s create your personalized moving budget. This transforms your question of ‘how much to save’ into a concrete action plan.

- Assess Your Finances: Calculate your monthly take-home income and track all expenses. List your debts and check your credit score—a good score helps with renting and utility deposits.

- Estimate Moving Costs: Use the categories we’ve covered to build your estimate. Get actual quotes from movers like Bernard Movers and research deposits in your target city.

- Research Cost of Living: Housing, utilities, and groceries vary dramatically by state. Use the 50/30/20 budgeting rule (50% needs, 30% wants, 20% savings/debt) to ensure your new location is financially sustainable.

- Create a Savings Timeline: Divide your total savings goal by the number of months until your move to get a monthly savings target. Track your progress with a simple spreadsheet. For more on budgeting for different move types, see our Out-of-State Moving Options guide.

Effective Strategies to Boost Your Savings

Saving thousands for a move is achievable. The key is to cut expenses while increasing income.

- Cut Expenses: Reduce spending on dining out, unused subscriptions, and impulse buys. Cooking at home and finding free entertainment can save hundreds monthly.

- Turn Clutter Into Cash: Sell items you no longer need via Facebook Marketplace, consignment, or a garage sale. This generates cash and reduces the weight (and cost) of your move.

- Increase Income: Consider side hustles like freelancing, delivery driving, or pet sitting. Put any windfalls like tax refunds or bonuses directly into your moving fund.

- Automate Your Savings: Set up automatic transfers to a high-yield savings account each payday. Treat it like a bill. For more tips, see our guide on the Least Expensive Way to Move Out of State.

Every dollar saved now provides security in your new state, allowing you to focus on the journey, not money worries.

Final Preparations and Making Your Move

You’ve done the hard work of saving and planning. Now it’s time to make your move from Illinois to your new destination! This final phase is about bringing your preparation together for a smooth relocation.

Your Financial Journey: Key Takeaways

After guiding thousands of Illinois families through relocations for over 50 years, we know that financial preparedness is the key to success. Here are the most important lessons.

- Be Realistic About Costs: The $4,000 to $10,000 savings range is based on real moves. An out-of-state move has many hidden costs, from utility deposits to DMV fees. Budgeting conservatively for these is key to arriving at your new home feeling confident, not stressed.

- Your Emergency Fund is Peace of Mind: An emergency fund with 3-6 months of living expenses is your safety net. Knowing you’re covered for the unexpected allows you to focus on the excitement of your new life, not financial worries.

- Research Your Destination: The cost of living difference between Illinois and your new state is significant. Researching your destination’s housing, utility, and other costs is a crucial investment in your long-term financial comfort.

Start Your Journey with Confidence

At Bernard Movers, we know that figuring out how much money to save before moving out of state is just the beginning. Our Chicago-based team has helped Illinois families manage these big life changes for decades. A successful move is about more than just transport—it’s about supporting you through the transition.

A Special Opportunity for Your Move

If you’re moving to Florida or Georgia, we have exciting news. Bernard Movers is offering a 20% additional discount on moves to Georgia and Florida booked for delivery by March 15, 2025. This special offer helps your carefully saved dollars go even further.

Your Long-Term Financial Success

This move is an investment in your future. By budgeting realistically and saving diligently, you’re not just preparing for a move; you’re building financial habits that will serve you well for years to come.

Ready to turn preparation into action? Start your journey with our expert out-of-state moving services, and let us help make your transition as smooth as the planning that brought you here.